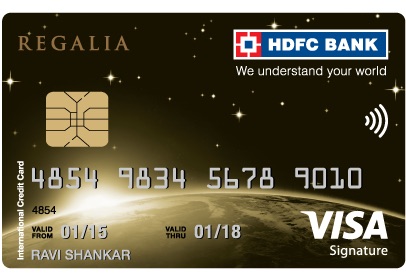

You’re hunting for a credit card with advantages for your lifestyle and travel. You’re in the right place then. Numerous traveling and lifestyle benefits are offered with the HDFC Bank Regalia credit card. Those who travel regularly would absolutely adore this card because it offers exclusive access to airport lounges, club memberships, and premium hotel advantages in addition to lifestyle bonuses. With all of these advantages, it is one of HDFC’s most well-known credit cards. The HDFC Regalia Card offers free accessibility to airport lounges both inside and outside of India as part of their commitment to luxury and travel perks.

Highlighted features

Foreign Currency Markup: 2% of all purchases made in a foreign currency. Six airport lounges outside of India are accessible, while there are 12 in India. No Responsibility for Lost Cards: In the awful situation that you lose your HDFC Bank Regalia Credit Card, as long as you immediately notify our 24-hour call center, you are not responsible for any unauthorized purchases made with your Credit Card.

Bonus 10,000 Reward Points on expenditures of Rs. 5 lakh and an extra 5,000 Reward Points on expenditures of Rs. 8 lakh in an anniversary year. For every Rs. 150 spent on all retail purchases, you receive 4 reward points. Continuous Credit: Take advantage of low-interest revolving credit on your HDFC Bank Regalia credit card. Dining Advantage: Free Zomato Gold membership and appealing discounts at top chain restaurants throughout India.

Milestone Advantage: If you spent Rs. 5 lakh during the anniversary year, you will receive a bonus of 10,000 reward points. If you spent Rs. 8 lakhs during the anniversary year, you will receive an extra 5,000 reward points. Advantage from annual expenditure: 15,000 reward points when the card is issued for annual spending over 8 lakhs. 10,000 reward points when the card is issued for annual spending over 5 lakhs.

Lounge Entry

Free access to airport lounges in India: 12 free visits each year to domestic and international airports lounges in India when using the HDFC Bank Regalia Credit Card. Visits that go beyond the allotted number of complimentary visits may be permitted, but they will also incur fees from the lounge.

Priority Pass: After making a minimum of four retail purchases with your HDFC Bank Regalia Credit Card, you could request for Priority Pass for yourself and other members. With Priority Pass, you and your accompanying member may use up to six free lounge accesses outside of India per calendar year. You will be charged US $27 + GST for each additional visit if you make more than the six complimentary ones.

Earning Reward Points: Eligibility & Refund

Get 4 reward points for every Rs. 150 spent on all retail* purchases, which includes paying for insurance, rent, utilities, and education. On yearly expenditures of Rs. 5 lakhs, you can get 10,000 reward points. Spend an additional Rs. 8,000 every year to get an additional 5,000 Reward Points.

Redemption of Bonus Points

Reward Points can be redeemed using Net banking or Smart Buy. Reward Points can be exchanged for the following: Hotel and flight bookings using Smart buy at a rate of 1 RP = Rs 0.5. Air miles conversion through net banking at a rate of 1 RP = 0.5 air mile. Cashback at a value of 1 RP = Rs 0.20. Products and Vouchers through Net banking or Smart Buy at a value of 1 RP = up to Rs 0.35

Insurance policies: Accidental air death insurance worth $1,000,000. Emergency medical care abroad: up to Rs. 15 lakhs. Up to Rs. 9 lakhs in Lost Card Liability Coverage. Surcharge for Fuel: 1% of the fuel fee is waived at all petrol stations in India with a minimal transaction of Rs. 400 and a maximal transaction of Rs. 5000.

Charges: Rs. 2,500 is the joining fee (plus applicable taxes). Taxes and the renewal fee is Rs. 2,500. Rs 99 Reward Redemption Fee (plus applicable taxes). Spend more than 3 lakh in the prior year to receive the annual fee waiver (from the second year on). All foreign currency transactions are subject to a 2% foreign currency markup. 3.6% monthly interest or 43.2% annually.

Eligibility criteria: For self-employed and salaried people, there are distinct eligibility requirements for the HDFC Regalia card: Salaried workers: The registrant should fall between the ages of 21 and 60.The individual’s monthly salary must be more than Rs. 1.2 lakh. Self-employed people: The person must fall within the age range of 21 to 65.The individual’s annual income tax return filing threshold is 12 lakh rupees.

Application procedure

Visit hdfcbank.com and select Credit Card under Products > Cards. then select “see all cards.” Click on “Regalia” under “Super Premium Credit Cards.” The “apply online” button will display alongside a picture of the card. An online credit card application will load after you click “apply online.” Fill out that form with your personal information, including your salary and PAN card number.

After filling out the form, press the “submit” button. After checking your information, the bank will decide whether to approve or deny your application according on the requirements. Following your credit card application, you can check the status of your HDFC application online or contact HDFC customer service. Additionally, you have the choice to apply for the Regalia credit card by going to the nearby HDFC Bank branch.

Limit for HDFC Regalia Credit Card

The credit limit on the Regalia Credit Card typically ranges from Rs. 2 lakh to Rs. 5 lakh. The card issuer may initially grant you a lesser credit limit, but if you use your card consistently and responsibly over time, they’ll eventually raise it. However, you can ask your card issuer to increase your credit limit if you are dissatisfied with the one that comes with your Regalia credit card. The quickest way to accomplish this is to speak with customer service and explain why you require a bigger credit limit. If you qualify, the bank will undoubtedly boost your credit limit.