It is known for its exclusive benefits and services tailored towards frequent travelers and individuals seeking luxury experiences. Travel Benefits: Cardholders receive access to a wide range of travel perks, including airport lounge access through the Global Lounge Collection (which includes Centurion Lounges, Priority Pass, and more), complimentary elite status with hotel and car rental programs, and airline fee credits for incidental expenses.

Membership Rewards Program: The card is typically linked to the Membership Rewards program, which allows cardholders to earn points for their purchases. These points can be redeemed for travel bookings, transferred to airline and hotel loyalty programs, or used for various other rewards such as merchandise or statement credits.

Annual Travel Credit: Cardholders receive an annual statement credit that can be used towards travel-related expenses, such as airfare, hotel stays, or other eligible charges. Fine Hotels & Resorts: Cardmembers gain access to the Fine Hotels & Resorts program, which offers benefits like room upgrades, late check-out, and complimentary amenities at participating luxury hotels worldwide.

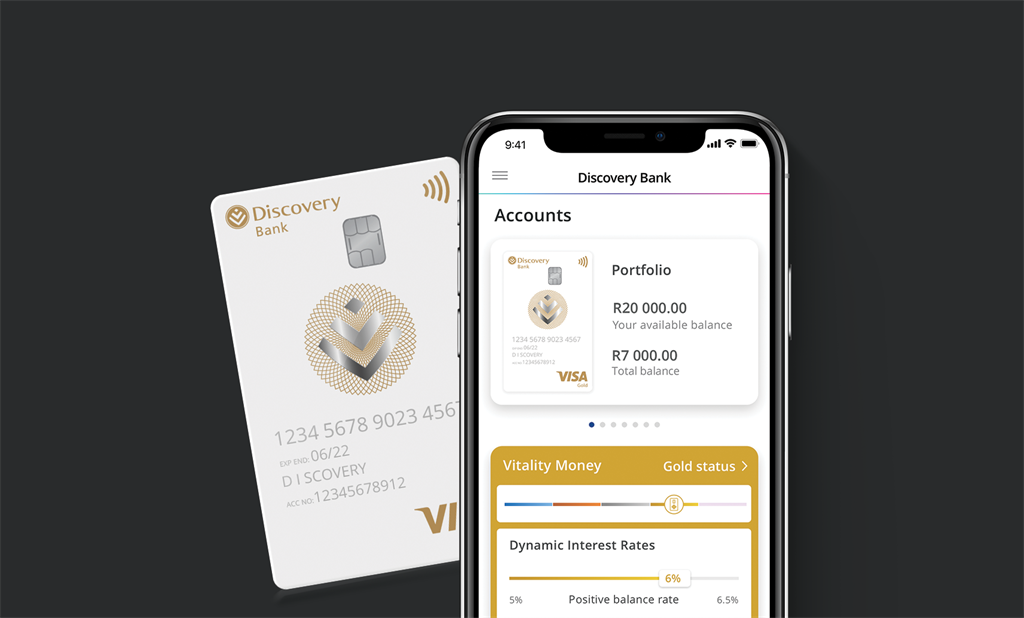

Global Assistance: The Discovery Gold card provides 24/7 global assistance, including emergency medical and legal services, roadside assistance, and travel insurance coverage. Concierge Service: Cardholders have access to a dedicated concierge service that can assist with travel bookings, dining reservations, event tickets, and more.

Luxury Experiences: offers exclusive experiences and events for Platinum cardholders, such as presale access to concerts, sporting events, and other entertainment. Annual Fee: The Discovery Gold card typically has a higher annual fee compared to standard credit cards. However, the extensive benefits and services provided often offset the cost for frequent travelers and those who maximize the card’s perks.

What are the advantages of Discovery Gold credit card?

The Discovery Gold credit card offers several advantages that make it a popular choice among frequent travelers and individuals seeking premium benefits. Here are some of the key advantages associated with the Discovery Gold credit card: Travel Benefits: The card provides a range of travel perks, including airport lounge access through the Global Lounge Collection, which includes Centurion Lounges, Priority Pass, Delta Sky Clubs, and more.

Cardholders can enjoy complimentary access and amenities at these lounges, such as comfortable seating, Wi-Fi, refreshments, and even shower facilities. Membership Rewards Program: The card is typically linked to the Membership Rewards program, allowing cardholders to earn points for their purchases.

These points can be redeemed for a variety of rewards, including travel bookings, airline and hotel loyalty program transfers, merchandise, statement credits, and more. The program offers flexibility and the potential for high-value redemptions. Annual Travel Credit: Cardholders receive an annual statement credit that can be used towards eligible travel-related expenses.

This credit can help offset the cost of airfare, hotel stays, rental cars, and other travel expenses, effectively reducing the card’s annual fee. Fine Hotels & Resorts: Cardmembers gain access to the Fine Hotels & Resorts program, which offers benefits like room upgrades (when available), complimentary breakfast, late check-out, and additional amenities at participating luxury hotels worldwide.

This program enhances the overall travel experience and provides added value during hotel stays. Global Assistance: The Discovery Gold card provides 24/7 global assistance, offering peace of mind to cardholders while traveling. This includes emergency medical and legal services, as well as access to roadside assistance and travel insurance coverage.

Concierge Service: Cardholders have access to a dedicated concierge service that can assist with various tasks, such as making travel reservations, securing dining reservations, obtaining event tickets, and more. This service adds convenience and can help with personalized travel planning.

Luxury Experiences: often offers exclusive experiences and events for Platinum cardholders. These can include presale access to concerts, sporting events, fine dining experiences, and other entertainment options, providing unique opportunities and enhancing cardholder privileges.

Elite Status and Benefits: The Discovery Gold card provides complimentary elite status with hotel and car rental loyalty programs, such as Marriott Bonvoy, Hilton Honors, and Avis Preferred. This can unlock additional perks like room upgrades, late check-out, priority service, and more.

How to get Discovery Gold credit card?

Check Eligibility: Review the eligibility criteria set by the bank. These criteria may include minimum income requirements, credit score benchmarks, and other factors. Ensure that you meet the eligibility requirements before proceeding. Application Process: Visit the website or contact their customer service to initiate the application process.

You can typically find a dedicated application page for the Platinum credit card on their website. Provide Personal Information: Complete the application form by providing your personal details, such as your full name, contact information, Social Security number (or equivalent identification number), employment information, and financial details.

Are there any restrictions on having a credit card?

Yes, there are certain restrictions and requirements associated with having a credit card. These restrictions can vary depending on factors such as your age, income, credit history, and the policies of the credit card issuer. Here are some common restrictions you may encounter: Minimum Age Requirement: In most countries, you must be at least 18 years old to apply for a credit card.

Some countries may have higher minimum age requirements, such as 21. Income Requirement: Credit card issuers often have minimum income requirements to ensure that applicants have the financial means to manage credit responsibly. The specific income threshold can vary depending on the card and issuer. Credit History: Your credit history plays a crucial role in obtaining a credit card.

Credit card issuers typically review your credit score and credit report to assess your creditworthiness. A limited or poor credit history may result in a higher likelihood of being denied a credit card or being offered one with higher interest rates and fewer benefits. Credit Limit: When you are approved for a credit card, the issuer assigns a credit limit, which is the maximum amount you can borrow using the card.

The credit limit is based on factors such as your income, credit history, and the issuer’s policies. Exceeding the credit limit can result in penalties and may negatively impact your credit score. Responsible Use: Credit cards come with the responsibility of managing credit wisely. It’s essential to make timely payments, avoid carrying high balances, and use the card within your means.

Failure to do so can lead to interest charges, late payment fees, and damage to your credit score. Terms and Conditions: Each credit card has its own terms and conditions, including fees, interest rates, and specific usage guidelines. It’s important to review and understand these terms before applying for a credit card to ensure that you can comply with them.

*You will be redirected to another website.