FNB is First National Bank in the country designated as South Africa that currently offers its Premier Credit Card. First National Bank is one of the bigger banks of South Africa. FNB offers different credit card services to its customers. FNB introduced the benefits of a premier credit card that is equally famous in adults as well as younger professionals. Its premier facilities are very beneficial for all of its customers.

FNB Premier Credit Card Involves some of the best business hubs of South Africa. This credit card brings some innovations in the life of South Africa’s people. It brings different rewards for its customers and helps them in bringing additional facilities to their range. FNB Premier Credit Card has various features and benefits for its customers and helps them in their business and personal life.

Premier Credit Card Benefits

FNB Premier Credit Card provides benefits to its customers in every field of life. Premier Credit Card recognizes that every person has unique needs, providing competitive and personalized credit interest rates. In addition, this credit card offers you services in the medical field. If you are planning any surgeries or facing any casualties, this card will help you on the spot. You can qualify for this medical facility by swiping your credit card. After this, you receive a message from the bank and attach it to the offer.

FNB Premier Credit Card has a partnership with Cycle Lab, iStore, the pro shop and Koodoo.co.za. You can purchase a different item from these stores with the Competitive interest rates applied. In addition, if you travel by buying tickets from eBucks Travel, you will get up to 12 additional slow lounge accesses. Slow Lounge is available on domestic as well as international flights for you and your family. This card also provides debt protection for its customers during emergency situations.

Premier Credit card offers you a 3x value back on a monthly basis for your online purchases. This credit card offers some premium offers for the customer’s help. Their customer care and control office has some professional persons who are available to help the customers. The bank official is available from 8 am to 6 pm from Mondays to Fridays and 8 am to 1 pm on Saturdays. Sunday is an official holiday, so the bank is closed on this day.

Insurance Policy of Premium Credit Card

You can get access to an insurance policy of 5 million with the Premier Credit Card. This insurance policy will cover you for the first 90 days of your trip. This travel insurance is also available at no charge and available for people below 70. You need to pay by using your FNB Premier Card or eBucks for your return ticket to enter this plan. You can avail of this facility worldwide by contacting the bank on the phone. This insurance policy will cover medical expenses, personal liability, lost baggage, flight delays, casualties, and emergencies.

Premium Credit Card features

FNB credit cards come with pin security features. The card has chips with extra protection measures associated with it. You can also enjoy a free interest purchase for 55 days from your FNB credit card. It provides its customers with a budget facility for free. You can choose to pay between ranges of periods from 6 to 60 months. You can place any purchase that exceeds 200 Rand on this budget facility.

FNB Premium Credit Card can save your time and money by using the option of auto payments. You can also experience safety and peace of mind with this facility. You can take this auto-payment offer from the FNB mobile app. The FNB app is beneficial for the customers as they can do all of the banking procedures from their mobile. However, you can buy any product, make any transactions, and avail check and balance facility from your mobile application.

FNB lost card protection policy provides its customers with the facility to stop their cards on the spot. You can do it via mobile app or by calling customer care. It will help you in protecting your card amount. The bank also offers the facility of SMS notification on every transaction through Premium Credit Card. Your transaction slip is also downloadable anytime with this mobile app. Moreover, you can transfer your balance for paying loans and debt at an interest rate of 15%.

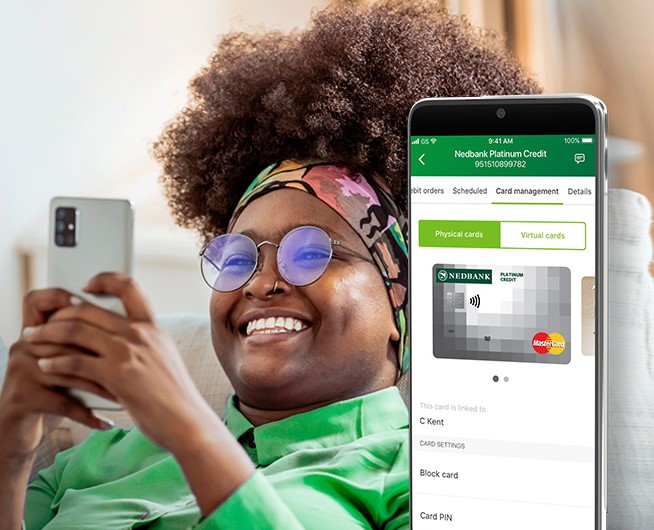

FNB Virtual Credit Card

FNB Premier Card has a virtual card offer, and it can be accessed from the mobile application. This virtual card increases your safety as the CVV number changes every hour. It is also usable in online purchases with extra protection. You do not need any physical cards for making these payments. You can also buy products on your insurance without any fee from this virtual card. Virtual cards assist you in shopping and other banking transactions with any person’s knowledge.

How to Apply for Premium Credit Card

You need to earn between 240,000 and 849,999 to get this card. Any individual who wants a FNB Premium Credit Card should have a South African ID. In addition, he needs to provide a copy of the recent pay slip. He should also have residence proof of not more than 3 months old. A bank statement of three months is also necessary for the application of Credit Cards of FNB.

The FNB Bank makes it easy for its customers to apply for the Premium Credit Card. Find a branch and fill a call me back form to apply for a credit card. Bank will contact you after that to confirm your identity. After this, FNB will provide you with the card. You can also apply online from the official website of the bank. Any individual can also apply from the FNB Banking application for mobiles.

*You will be redirected on a different page.