Kogan is a public company founded in 2006 by Ruslan Kogan and is responsible for the Kogan Money Credit Card. Kogan is an Australian public company providing retail, marketplace, insurance, internet, mobile, and travel services. The company’s head office is in Melbourne, Australia. Kogan is currently providing services in Australia, New Zealand, and the United States. The company’s sales are increasing day by day.

In the current day, Kogan is selling products of above one million dollars. Due to these high selling ratios, Kogan has introduced their credit card named Kogan Money Black Credit Card. Kogan Money Credit Card is very effective for shopping from Kogan.com. Kogan sales executives promote this card because it provides different benefits for shopping on the Kogan website.

The extra charges for this credit card are low as compared to other credit cards of different banks. Kogan is providing safety in the transactions and shopping from their website. This credit card is bringing the reward policy exclusively for its customers. These rewards are available for shopping from any online store. Let’s discuss all of the features and benefits of this credit card in detail here.

This Kogan Money Credit Card charges zero dollars as the annual fee through the ownership period. Payout $1,500 on eligible purchases within 90 days of receiving your card. You will get 400$ as credit with this credit card. This credit card charges 0% p.a. on balance transfer for 12 months. After this, it reverts to a cash advance rate of 21.74% p.a.

Kogan Money Credit Card benefits and features

Any customer did not get any interest-free day after the balance transfer. So, be aware before doing that. The individual cardholder can add up to 4 additional cardholders without extra costs or charges. Its reward policy is very attractive for its customers. This Credit Card is providing real value rewards for its customers.

The customers can earn up to 2 reward points on the eligible purchase of One Dollar from the Kogan website. Collect these reward points, and when it becomes 100 points, you can credit them, which will give you 1$. Make routine purchases with your Kogan Credit Card. On all eligible transactions, Customers gain points.

By getting free Kogan First Membership, you’ll get free shipping on thousands of products, the fastest delivery upgrades, and special offers at Kogan.com. It has a 20.99% p.a. as retail purchase rate. Kogan Money Black Credit Card’s minimum credit limit is 6000$. Kogan provides interest-free 55 days on retail purchases for those customers who do not have any balance transfers.

The Kogan Money Credit Card is charging 5% of the transacted amount as foreign cash advance fee. Whenever any direct debit payment has been dishonored, you pay 15$, and Kogan which Kogan will withdraw from your balance at the time of the dishonor. Every time when Customers cannot pay the due within the acquired time, then the bank will charge 30$ extra as a late payment fee. The company will directly deduct these 30$ from your account when the payment due date ends.

Kogan Money Credit Card safety measures

Kogan Money Black Credit Cards are Visa supporting credit cards. The Kogan Money Black Card comes with all standard Visa capabilities, such as Visa payWave for tap-and-go payments under $100 and Fraudshield and Visa Zero Liability for safe and secure amount transfer from the card.

With Visa Paywave, you can securely pay any amount with just a wave of your card and shop for different things. Fraudshield and Visa Zero Liability Policy protect all the Kogan Money Credit Card transactions. Fraudshield is monitoring the Kogan Credit Card 24/7. When anyone does bogus or fraud transactions, card owners can know about it.

Visa’s Zero Liability Policy ensures that you will not be liable for illegal charges made on your account or using your account details. If your Visa debit or credit card is lost, stolen, or fraudulently used online or offline, you’re compensated. Hence, it is safe to use the Kogan cards for any shopping from online stores.

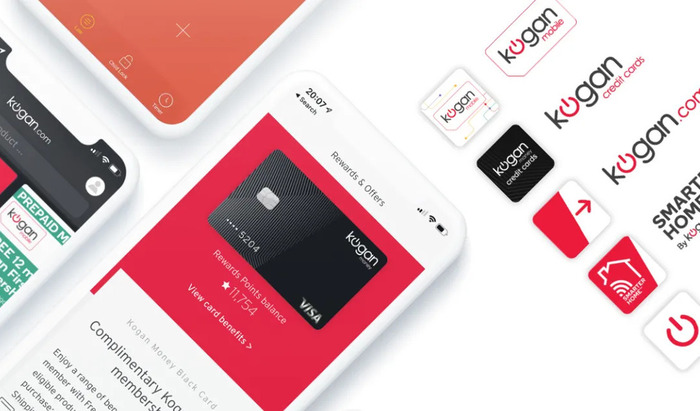

Mobile application

Kogan has developed a mobile application available at all online mobile stores for the consumers and owners of this credit card. The cardholders can also use Kogan mobile application for online shopping across Australia, New Zealand, and the United States. Use Apple Pay to get all of your Kogan Credit Card benefits on your iPhone, iPad, Apple Watch, and Mac.

Apple Pay is simple to use and compatible with your phone. It’s safe because your card information isn’t saved on your phone or exchanged when you purchase. It’s never been easier, safer, or more private before this to pay in stores, apps, or on the web. Keep reading and you will learn how to apply for your new credit card.

Eligibility criteria and application procedure

Kogan Money Credit Card has specific eligibility criteria for its customers. The person who wants a Kogan credit card is either full-time or part-time employed. A self-employed person should have a good credit history. The earning for the person applying should be more than 35000$ per year.

The applicant should be at least 18 years old. The person has to submit a permanent Australian residency certificate. A valid email address and mobile number are also necessary to obtain a Kogan Black Credit Card. The application procedure for Kogan Credit Cards is not tricky. This process will take less than 15 minutes.

You should provide an authentic email address and mobile number and all of the information provided in the eligibility criteria to process the application for the Kogan Money Credit Card. Kogan authorities counter-check that information and then provide you with the Kogan Credit Card. However, in case of any assistance, you can call their number between 9-5 during working days.

*You will be redirected to a different page.