Nedbank Platinum Credit Card is a premium credit card offered by Nedbank, one of South Africa’s leading financial institutions. It is designed to provide users with an exclusive range of benefits and features, making it an attractive option for those seeking a high-end credit card.

Benefits of Nedbank Platinum Credit Card

Rewards Program: With the Nedbank Greenbacks Rewards program, users earn points for every Rand spent on their Platinum Credit Card. These points can be redeemed for travel, shopping, and other lifestyle rewards. Travel Benefits: The Nedbank Platinum Credit Card offers a range of travel benefits, including complimentary access to the Bidvest Premier Lounge at local airports, travel insurance, and a concierge service to help with travel arrangements.

Lifestyle Benefits: The card also offers a host of lifestyle benefits, such as access to exclusive events and offers, discounts on dining and shopping, and complimentary access to fitness centers and golf courses. Security Features: The Nedbank Platinum Credit Card offers advanced security features to protect against fraud, including chip and PIN technology and SMS notification alerts for transactions.

How to apply for Nedbank Platinum Credit Card

Check eligibility: Before applying for the Nedbank Platinum Credit Card, you need to meet the eligibility criteria, such as a minimum income requirement. Gather Documents: You will need to provide various documents to support your application, such as proof of income, identity documents, and proof of address.

Apply Online: The easiest way to apply for the Nedbank Platinum Credit Card is through the Nedbank website. You will need to fill out an online application form and submit your supporting documents. Wait for Approval: After submitting your application, Nedbank will review your application and credit history to determine your eligibility for the card.

If approved, you will receive your new Nedbank Platinum Credit Card in the mail. In conclusion, the Nedbank Platinum Credit Card is an excellent choice for individuals seeking an exclusive range of benefits and features. With its rewards program, travel benefits, lifestyle perks, and advanced security features, the card offers great value for money.

What are the advantages of Nedbank Platinum Credit Card?

The Nedbank Platinum Credit Card comes with a range of advantages that make it an attractive option for many consumers. Here are some of the key benefits: Reward program: With the Nedbank Greenbacks rewards program, you can earn points on your purchases that can be redeemed for a variety of rewards, such as travel vouchers, electronics, and even cashback.

Travel benefits: The card comes with a range of travel benefits, including access to airport lounges, travel insurance coverage, and discounts on car rentals and hotels. Lifestyle benefits: The Nedbank Platinum Credit Card offers a range of lifestyle benefits, such as exclusive discounts on entertainment, dining, and shopping.

High credit limit: The card offers a high credit limit, which can provide you with greater financial flexibility and allow you to make larger purchases. Contactless payments: The card comes with contactless payment functionality, which makes it quick and easy to make purchases without having to insert your card or enter a PIN.

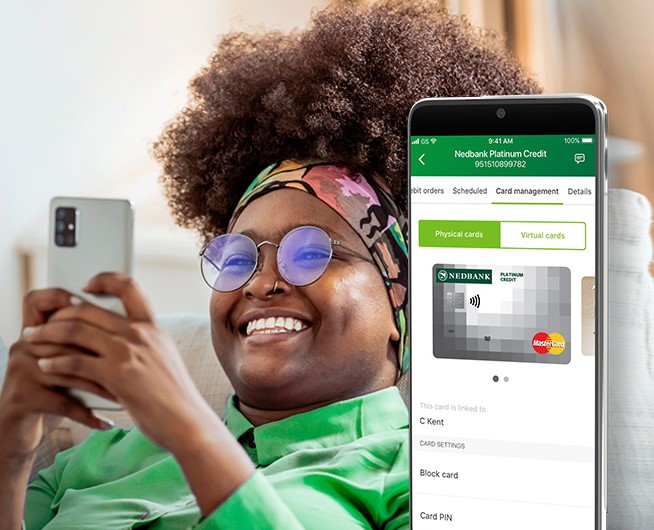

Additional cards: You can request additional cards for family members, which can help you earn rewards more quickly and manage expenses more effectively. Fraud protection: The card comes with advanced fraud protection measures, including SMS notifications for transactions, 3D Secure authentication, and the ability to lock and unlock your card through the Nedbank Money app.

Overall, the Nedbank Platinum Credit Card offers a range of benefits that can make it a valuable addition to your wallet. However, it’s important to review the terms and conditions carefully, including any fees and interest rates, to ensure that it’s the right option for your financial needs.

How can I get Nedbank Platinum Credit Card?

To obtain a Nedbank Platinum Credit Card, you must first be a Nedbank customer. You can apply for the card online or in person at a Nedbank branch. The application process involves providing personal and financial information, such as your income, employment status, and credit history.

Nedbank will use this information to determine your eligibility for the card and to set your credit limit. To be eligible for a Nedbank Platinum Credit Card, you must meet certain requirements, including having a good credit score and a stable income. Additionally, you must be a South African citizen or permanent resident, and you must be over 18 years old.

Once your application is approved, you will receive your card in the mail. You will also be provided with instructions on how to activate the card and set up your online account. It’s important to keep in mind that the card may come with certain fees and charges, such as an annual fee, interest charges, and cash advance fees.

Overall, the process of obtaining a Nedbank Platinum Credit Card is relatively straightforward, provided that you meet the eligibility requirements and have a good credit history. If you’re interested in applying for this card, it’s a good idea to review the terms and conditions carefully and to compare it with other credit card options to ensure that it’s the right choice for your financial needs.

Are there any restrictions on getting a credit card?

Yes, there are several restrictions on getting a credit card. These restrictions are put in place by credit card issuers and are designed to ensure that only qualified individuals are able to obtain a credit card. Some of the common restrictions include: Age requirement: To apply for a credit card, you must be at least 18 years old in most countries. In some countries, the age requirement may be higher.

Income requirement: Credit card issuers typically require applicants to have a minimum income to qualify for a credit card. The income requirement varies depending on the card issuer and the type of credit card. Credit score: Credit card issuers also look at the applicant’s credit score to determine their creditworthiness. A good credit score is usually required to qualify for a credit card.

Employment status: Credit card issuers may require applicants to have a steady source of income, such as a job or business, to qualify for a credit card. Existing debt: If an applicant has a lot of existing debt, such as outstanding loans or credit card balances, it may be difficult for them to qualify for a credit card. Bank account: Some credit card issuers may require applicants to have an existing bank account with them or with a partner bank to qualify for a credit card.

Overall, the restrictions on getting a credit card are designed to protect both the credit card issuer and the applicant. By ensuring that only qualified individuals are able to obtain a credit card, credit card issuers can minimize their risk of defaults and ensure that they are lending to responsible borrowers.

*You will be redirected to another website.