Vanquis Credit Card belongs to the Provident Financial Group, which owns the Vanquis Bank. The bank was founded in 2007 to provide credit-building credit cards under the Visa brand to UK individuals who have a restricted or inconsistent credit history. Read our article to know more about this amazing card.

It also has fixed-rate bonds services, which were introduced in 2011. The Vanquis Credit Card has introduced various cards for specific benefits. A credit card for establishing a reputation is important to consider if your credit rating is suffering from previous financial troubles or if you’re trying to pick on credit for perhaps the first time.

The bank has a motto of saying yes to more individuals with their card collection. No matter where customers are, they may begin their journey to better credit. Everyone has the opportunity to enhance their daily lives and credit scores. Keep reading our article to know all the details about the Vanquis Credit Card.

Features of the Vanquis Credit Card

The Vanquis Credit Card has three different versions for its customers. Every card has specific consumers. The first one is the Vanquis chrome card. This credit card has the highest credit limit among vanquish credit cards, and it has a starting credit limit of £1,200. It comes with 29.5 percent APR which is variable for different conditions.

The higher credit limit makes this card highly valuable. If you have any issues or concerns, you can contact Vanquis Bank’s UK customer service team. The second one on the list is Vanquis’s classic credit card. This credit card has a starting limit of £750. The traditional card has 39.9 percent APR for its customers, and it is also variable according to conditions and tax applied.

The third one on this list is Vanquish Original, with a starting credit limit of £250. It has an expected value of 59.9 percent APR. All these credit cards define various ranges of credit limits for different customers. The Vanquis Credit Card is a member of the Visa program, and it can be used in countless different places throughout the world.

Visa Secure helps secure the Vanquis Credit Card against internet scams by making it more difficult for others to use it without your authorization. Vanquis is also entirely supervised by the Financial Conduct Authority (FCA), and the Consumer Credit Act protects you. You’ll get a complete refund if anything goes wrong with a transaction between £100 and £30,000.

Credit building cards

Vanquis Credit Card can assist its customers if they have bad credit or want to improve or preserve their honor. Bad credit cards give you a practical tool to keep track of your finances. When you apply for one of the credit building credit cards, the bank will provide you with a low credit limit to ensure you don’t get into too much debt.

However, to lessen the quantity of interest anyone pays, spend off more than the least and, if feasible, the entire sum each month. The customer’s credit score will suffer if they fail to make a payment. Credit Card users establish a Direct Debit or another fully automated charge for at least a minimum amount to ensure they never miss payments.

The bank tells its customers not to use up all of their credit, and if they do, make an effort to pay off the balance in full every month. This will ensure that cardholders don’t pay interest on their purchases and demonstrate to lenders that they are not overly dependent on credit. The Vanquis Credit Card is accessible to millions of people around the globe without any significant effort.

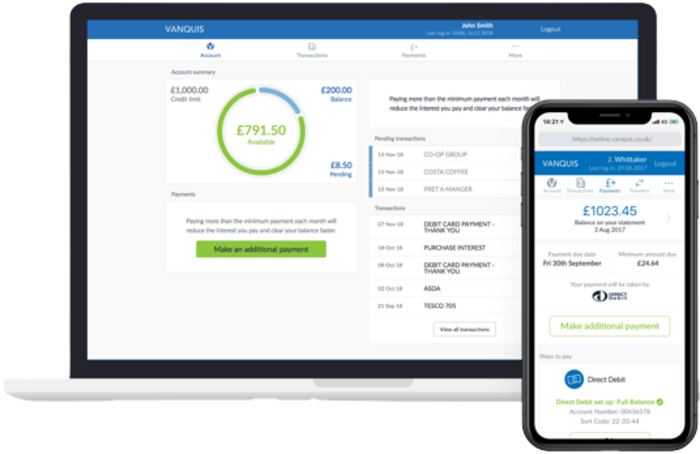

Vanquis Mobile App

Customers can check their account summary, including the Vanquis Credit Card credit limit, balance, and transactions, in one convenient location. The cardholder can see what’s pending and new with this mobile app. However, Individuals can look at up to six months’ worth of statements. They can make payments that are quick, simple, and safe. Customers can download this mobile app from any online store and log in with their credit card credentials.

Vanquis Credit Card eligibility criteria

To apply for the Vanquis Credit Card, customers need to provide their full name and permanent address. Applicants should also provide their date of birth and residential status. The bank will also know the time at your location and all the contact details. The person needs to have a permanent income source.

This income source may be a salary or other monthly income proof. The bank will also ask about the monthly expenditure of applicants. If the applicants pass the preliminary credit card eligibility check, the bank will require their three-year address history and their bank account and debit card information.

The credit card applicants must also verify that they are at least 18 years old, a UK resident, not bankrupt, and commit to a comprehensive credit check. The method looks complex, but the bank officials are highly trained and quick to do this task. The bank offers an eligibility checker opportunity for its customers to check their eligibility.

Customers’ eligibility gives them an idea of which credit card they should choose. The Vanquis Credit Card applicants have the chance to apply manually by visiting any nearby branches. The bank also allows online customers to submit an online application by providing all the details mentioned above. Enjoy the credit card benefits by getting these cards in a few working days.