AfrAsia Bank is the banking system introduced by the Bank of Mauritius in 2007 and now has a AfrAsia World Credit Card. AfrAsia Bank has its representative office in South Africa. This Bank builds a bridge between Asia, Africa, and the whole world. AfrAsia Banking is one of the most reliable systems. Recently, the AfrAsia banking system introduced the World Master Card facility to its customers.

AfrAsia World Credit Card is the best thing to happen to this Bank in recent times. This Mastercard brings the quick banking and fastest payment option to its consumers worldwide. The World Credit Card helps travel, business, shopping, and managing finances of different individuals and companies. The World mastercard technology makes life easy for the customers of this Bank in every part of the world.

Benefits of AfrAsia World Credit Card

AfrAsia World Credit Card provides the facility of worldwide usage. It is accepted in all parts of the world without any problem. This Credit Card deals with three currencies in the world: US Dollars, Euros, and Mauritian Rupee. AfrAsia World Credit Cards also sends detailed monthly statements to its customers as an e-statement. Its best feature is that it gives the facility to individuals to determine their credit limits. It means you can estimate your expenses and get the boundaries according to your estimate.

AfrAsia Credit Card also brings the opportunity of interest-free 100% repayment to its customers up to 48 days. You can enjoy unlimited complimentary lounge access with this credit card. It carries exclusive offers for its customers on different occasions and time periods. You can easily shop, withdraw, and send payments by using AfrAsia Credit Card. This card only has 15% interest per annum on Maritain Rupee Balance. On the other hand, for USD or EUR balances, it has 9% interest per annum.

XtraMiles Program by AfrAsia Credit Card

AfrAsia Master Card brings the program of Xxtramiles for its users. The XtraMiles program allows you to accumulate points and then quickly redeem them on its live platform. This program provides the possibility of redeeming on more than 800 airlines, 45,000 car rental locations, and almost 200,000 hotels worldwide. You also have the opportunity to exchange it for getting lounge access at various places in your journey. You will get one Xtramile by spending every 1 USD or 30 MUR from your credit card. This credit card also brings discounts on different types of purchases.

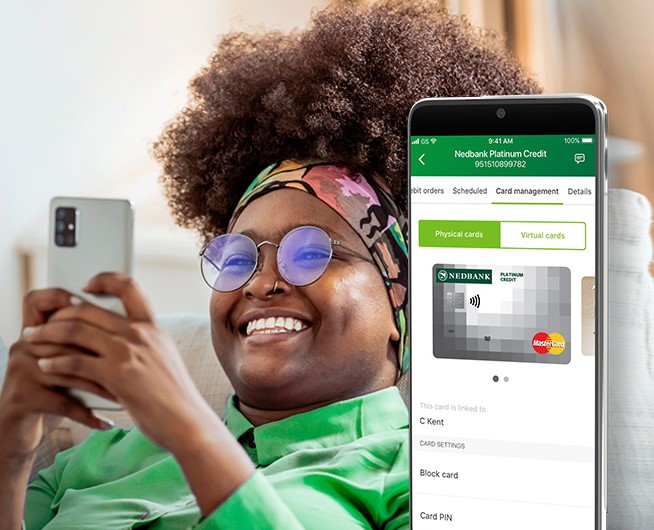

AfrAsia Free Mobile Application

AfrAsia Banking system has a free mobile application for its customers. This mobile application is made for android mobiles as well as for iPhones. So, the Bank customers need to go to their play store or apple store and install this application. Then, put in the necessary information of your bank account and credit cards and start enjoying the mobile application features.

AfrAsia mobile application allows customers to monitor their accounts continuously. They can activate or deactivate their cards. They can change the passwords and pins for their credit cards. Any individual can access its previous ten transactions with this application. This Mobile application keeps its users up to date about their accounts. It’s easy and modern.

Protection for AfrAsia World Credit Card

AfrAsia Bank provides its customers with necessary protective measures in using the World Credit Card. It brings the contactless cards with EMV (Europay, MasterCard®, and Visa®) chips and pin security to enhance the protection. In addition, AfrAsia World Credit Card has 3-D security to secure it during online shopping. These facilities are a guarantee of safe banking by these credit cards all over the world.

The AfrAsia Bank customers have to follow different safety measures to use this Credit Card. First, check the authenticity of the website or online stores before providing the Master Card details. Second, keep your mobile application and browsers like Chrome, Opera, and Firefox updated to avoid any fraud. Otherwise, Hackers can hack your passwords and other necessary information. They can use this information to transfer your funds for their own purposes.

Insurance Facility

AfrAsia World Credit Cards allow its customers to get insured. The insurance amount is claimed in the local payment for every country. Insurance facilities are used for traveling and medical care in normal and accidental situations. Hence, you can get different insurance packages for various types of criteria. The maximum insurance amount is 500,000 USD which is approximately equal to 7,623,655 South African Rand (according to current rates).

The sub-limits of this currency bring benefits to the Spouse and children of the customer. The Spouse can get the 50% in all accidental and health coverage. The children can get 10% of the benefits from these criteria. The Master Credit Card Insurance policy keeps you safe from the unforeseen at home and overseas. This makes this credit card a good option for you and your family.

How to apply for World Credit Card

Afro-Asian Credit Card is provided to its customers who have opened an account in a Bank. Therefore, you need to provide all the necessary information to the Bank officer to open your account in the Bank and apply for the World Credit Card. You can also apply it online from the AfrAsia Bank Website or mobile application. It’s easy and fast to apply for yours.

Go to the site and provide your first name and last name. Then, provide your phone number and email and apply. The Bank Customer Care will call you for further steps and make you their client. After this process, you can apply for a Credit Card. Finally, you will get it within the authorized time. You set your pin for the card and can use it afterwards. Do not miss the opportunity!

*You will be redirected to another website