The American Express Platinum Card operates as a charge card within the premium travel segment, featuring an annual fee structure that positions it among high-tier financial products in the U.S. market.

The card requires full balance payment each statement cycle, distinguishing it from traditional revolving credit products.

Recommended Articles

Below are helpful, related guides.Cardholders access a network of services spanning airport facilities, hotel partnerships, and transportation benefits. The product targets consumers with significant annual travel expenditure and established credit profiles.

American Express reports that Platinum cardmembers typically maintain higher-than-average spending patterns across travel and entertainment categories.

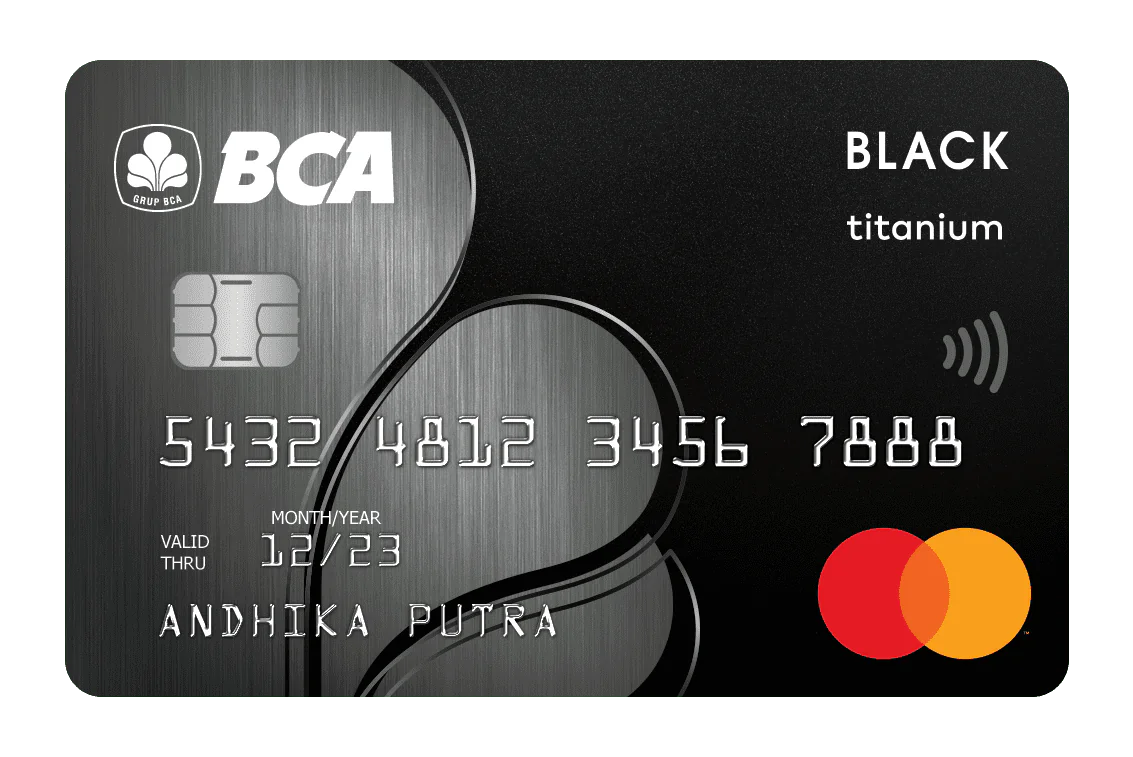

The card’s metal construction and distinctive design serve functional and brand recognition purposes. The weight and composition differ from standard plastic cards, reflecting manufacturing specifications tied to the premium positioning strategy.

Airport Lounge Access Networks

Platinum cardholders receive complimentary entry to over 1,400 airport lounges globally through multiple networks. The primary access includes American Express Centurion Lounges, Priority Pass Select membership, and Delta Sky Club access when flying Delta.

Centurion Lounges operate in major U.S. airports and select international hubs, offering complimentary premium food, beverages, and workspace amenities. Each location features chef-curated menus and full bar service at no additional charge. The lounges accept the primary cardholder and up to two guests, or unlimited family members traveling on the same reservation.

Priority Pass Select provides the highest membership tier within that lounge network, covering access to approximately 1,300 lounges worldwide. This network extends to airports where American Express does not operate proprietary facilities, filling geographic gaps in coverage.

Delta Sky Club access applies when the cardholder flies Delta or partner airlines on the same day. This benefit does not extend to guests, limiting usage to the primary cardholder only. Restrictions apply during peak hours at certain locations.

The Plaza Premium Lounges network adds supplementary access points in regions with limited Centurion or Priority Pass presence. International transfer hubs and secondary airports comprise the majority of these facilities.

Hotel Partnership Benefits and Status Recognition

The Platinum Card includes automatic enrollment in hotel loyalty programs with elevated status levels. Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status activate upon card approval without qualifying night requirements.

Marriott Gold Elite Status provides room upgrades when available at check-in, late checkout until 2 PM subject to availability, and 25% bonus points on eligible purchases. The status applies across Marriott’s portfolio, which encompasses approximately 8,000 properties under 30 brands globally.

Hilton Honors Gold Status offers similar upgrade benefits, along with complimentary breakfast for up to two guests at participating hotels. The breakfast benefit varies by property type, with some locations offering food and beverage credits instead of full breakfast service.

The Fine Hotels + Resorts program grants access to a curated collection of luxury properties with standardized benefits. Bookings through this program include room upgrades upon arrival when available, daily breakfast for two, guaranteed 4 PM late checkout, complimentary Wi-Fi, and a property-specific amenity valued at $100.

Hotel Collection properties provide a mid-tier alternative to Fine Hotels + Resorts, featuring guaranteed late checkout and hotel credits rather than breakfast benefits. This collection includes over 1,000 properties at various price points.

Annual Statement Credits and Purchasing Power

The card provides multiple annual statement credits designed to offset specific expense categories. These credits apply automatically when qualifying purchases post to the account.

A $200 annual airline fee credit covers incidental charges from one pre-selected U.S. airline. Eligible purchases include checked baggage fees, in-flight refreshments, seat selection fees, and phone booking charges. Airline ticket purchases do not qualify. Cardholders must designate their airline choice annually through the American Express portal.

The $200 Uber Cash benefit divides into monthly allocations, providing $15 monthly credits January through November and $20 in December. Credits apply to Uber rides and Uber Eats orders within the United States. Unused monthly credits do not roll over to subsequent months.

A $189 CLEAR Plus membership credit covers the full annual cost of CLEAR airport security screening service at participating U.S. airports. The credit applies after the membership posts to the Platinum Card account. CLEAR members access dedicated security lanes using biometric verification technology.

Global Entry or TSA PreCheck application fee reimbursement reaches $100 every four years. The credit covers one application fee within that period, accommodating the five-year validity of Global Entry memberships.

Digital entertainment credits include $20 monthly for eligible purchases at select streaming and digital media services. Annual value totals $240 when fully utilized across qualifying merchants.

Travel Protections and Insurance Coverage

Trip cancellation and interruption insurance provides reimbursement up to $10,000 per trip when cancellation results from covered circumstances. Eligible reasons include illness, injury, severe weather, or other specified events. The coverage applies when the cardholder books the entire trip using the Platinum Card.

Baggage insurance plans cover up to $2,000 for carry-on luggage and $3,000 for checked bags per passenger. Claims require documentation of loss or damage occurring during carrier custody. Standard exclusions apply for jewelry, electronics, and perishable items beyond specified limits.

Car rental loss and damage insurance serves as primary coverage when the cardholder rents using the Platinum Card and declines the rental company’s collision damage waiver. Coverage includes theft and collision damage to most rental vehicles. Exotic vehicles, trucks, and long-term rentals fall outside coverage parameters.

Trip delay insurance reimburses up to $500 per ticket for meals and accommodations when delays extend beyond six hours. The carrier must cause the delay, and the cardholder must book using the Platinum Card to activate coverage.

Emergency medical and dental coverage extends to cardholders and immediate family members traveling together, providing up to $10,000 in benefits during trips. The coverage supplements existing health insurance rather than replacing primary medical coverage.

Purchase Protections and Extended Warranties

Purchase protection covers eligible items against damage or theft within 120 days of purchase. Coverage extends to $10,000 per occurrence with a $50,000 annual maximum. The cardholder must purchase the item entirely using the Platinum Card to activate protection.

Extended warranty service adds one additional year to manufacturer warranties of five years or less. Electronics, appliances, and other tangible goods qualify for coverage. Software, vehicles, and items without original manufacturer warranties fall outside the program scope.

Return protection enables cardholders to return eligible items to American Express when merchants refuse returns. The program provides up to $300 per item with a $1,000 annual limit. Strict time limitations and documentation requirements govern claim approval.

Global Assist Hotline provides 24-hour coordination services for medical, legal, financial, and travel emergencies occurring more than 100 miles from home. The service coordinates assistance but does not cover costs directly. Cardholders pay for services rendered and may submit claims to applicable insurance coverages afterward.

Fee Structure and Qualification Requirements

The annual fee stands at $695 per year, billing automatically to the account. Additional cards for authorized users incur no separate fee, allowing family members or employees to access card benefits under the primary account.

American Express evaluates applications based on credit history, income levels, and existing relationship with the company. The issuer does not publish specific credit score requirements, though approval typically requires excellent credit standing. Self-reported income verification occurs during the application process.

The card carries no foreign transaction fees on purchases made outside the United States. This structure benefits international travelers by eliminating the 2-3% surcharge common on many competing products.

Late payment fees reach up to $40 for overdue balances. Returned payment fees match this amount. Charge card structures require full payment each statement period, with interest charges applying only to Pay Over Time eligible purchases when that feature activates.

Cash advance capabilities exist with applicable fees and interest rates. The issuer discourages cash advances through higher APRs and immediate interest accrual without grace periods.

Merchant Acceptance and Network Limitations

American Express operates a proprietary payment network separate from Visa and Mastercard. Merchant acceptance rates in the United States reach approximately 99% of locations accepting credit cards, according to company disclosures. International acceptance varies significantly by region.

Smaller merchants and certain business categories maintain lower acceptance rates due to higher merchant processing fees associated with American Express transactions. Gas stations, small restaurants, and independent retailers represent common gaps in acceptance coverage.

The card enables purchases exceeding traditional credit limits when spending patterns and payment history demonstrate capacity. This feature applies unevenly across cardholders based on individual account management. American Express evaluates large purchases in real-time before approval.

Contactless payment technology embedded in the card enables tap-to-pay transactions at compatible terminals. Mobile wallet integration includes Apple Pay, Google Pay, and Samsung Pay platforms.