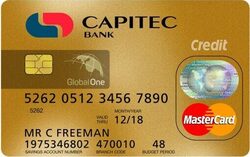

Capitec Bank is the most rapidly growing bank in South Africa. From the last survey in November, it nearly had 13 million trustable customers. Millions of people are getting benefits from their reliable credit cards and other banking services. This fast-moving company is registering 200 000 customers each month. Capitec banks go on with an average of 14 000 new credit card accounts in a month. This is a highly successful acceptance rate in view of the present economic conditions.

Company vision

You might ponder upon the fact why the growth rate of this company is exorbitant. The answer is in their mission statement. It says ‘commitment to making banking affordable, easy to access and delivered through a personalized experience.’ The aim is strong. Therefore, the Capitec bank is struggling hard to achieve it. Generally, Capitec Credit Card is for individual use with a supportable income source.

Key Features And Benefits Of Capitec Credit Card

Black Card facilities

Let’s talk about the Capitec Black Card facility. It is identical to the previous Credit Card. There is only a color difference between both. The customers can earn 2.25% per annum on a regular positive balance. They can enjoy up to 55 days with no interest. Besides, a credit limit of up to R250000.00.

They can also pay a personalized interest rate of 7.00% per year. Capitec Bank has changed its credit card color into black, that is the reason it is now known as the Capitec Black Card. However, the qualifying standards are the same as the simple ones. Moreover, Capitec bank is facilitating its clients. As it is accepting many credit card requests in these hard pandemic times.

Low interest rates

The opportunities for their customers are endless. If you ask Capitec as a bank customer, they will get you through a seller in the Credit card department. He will inform you that Capitec bank allows low interest on credit. In addition to it, customers will earn interest on a positive balance. So above all, we presumed that Capitec Bank is doing well relative to the other finance banks.

Amazing offers and hospitality of the Capitec Credit Card

Capitec credit cards have given amazing offers to its clients. Capitec credit cards cover the needs of all persons. Specifically for such individuals who want a credit card for traveling. Furthermore, it is most useful for those who prefer entertainment. The credit card is highly affordable to satisfy your instant requirements. However, the Capitec credit card does not provide any support or bonus points when using the credit card to purchase their traveling tickets, hotel bookings, paying car rents, etc.

Minimum income conditions

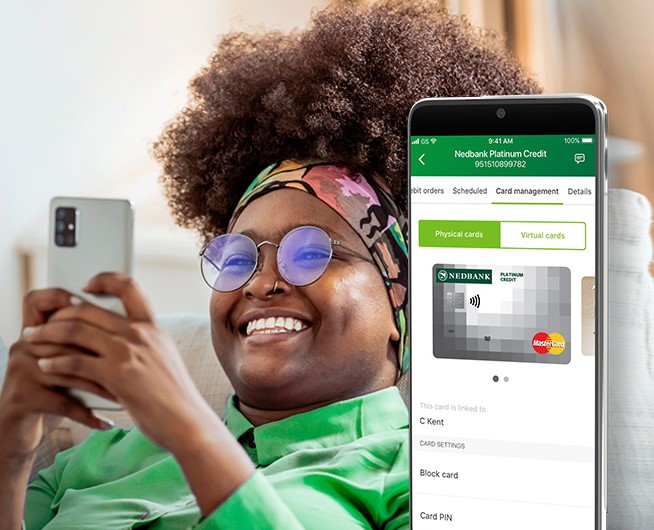

If you are a permanent employee and earn R3000 or more in a period, you can receive a Capitec Black Card. Comparing the Capitec credit card with Standard Bank, Absa, FNB, and Nedbank, it is the lowest initial range credit card. Besides, it has the least income requirements. Capitec credit card allows its customers 55 days’ time to settle their debt. Most importantly, it is good to clear your credit well before the due dates. You may utilize their Capitec App to clear the amount in an easy and fast way.

How To Apply For Capitec Credit Card

If you wish to apply for your Capitec credit card, visit your most neighboring Capitec Bank branch. In addition to it, you can apply online. If you hold the app, you can apply on the app by creating your profile. The requirements to apply for a Capitec Credit Card are very general and easy. Firstly, you must be 18 years or old and have a South African identity. Secondly, you must have your latest payslip. Lastly, the Capitec bank requires the latest stamped bank statement.

Bonus And credit limit

Let’s talk about the best benefits of the Capitec credit card. First, Capitec ensures you gain 2.25% on the positive balance. These money services are available for their usual clients. Second, they are coming up with amazing credit limits up to R250,000,00. Therefore, your credit is personalized according to your credit scores and it significantly depends upon your history.

Third, they must check your affordability. Fourth, their interest rate starts from 7.00%. Fifth, they charge 00 currency conversions when you buy with your card abroad. Sixth, you can hand up to 55 days of credit limit after the purchase. Last, you can effortlessly gain access to all of your credit cards.

Wonderful travel experience

You can experience a wonderful free travel basic insurance. They will provide you with highly discretionary credit insurance as well. Fast-growing earners with an outstanding credit score are directed to be accepted for a high credit amount which is up to R250,000.00. Meanwhile, your credit score is important for applying for any credit. Similarly, it is also necessary when applying for a Capitec credit card.

Lowest interest rates

It is imperative to keep a sound credit record to qualify for the lowest interest rate. In other words, this low rate will assist you so much in settling your debt amount. There is a 10 to 5% difference in the interest rates you should utilize for you and it does not directly pay for a higher interest rate.

It is beneficial if you take benefit of the 55 days grace period to evade interest rates on credit cards. The other advantage is the minimum salary requirement that is only R3000.00. This is cheaper than the general salary. So, hypothetically every employed individual can easily afford it.

*You will be redirected to another website.