FNB is First National Bank in the country named South Africa that now offers its Petro Credit Card. FNB is one of the country’s big five banks. Its origin is found in Eastern Province Bank, which was formed in 1838. FNB provides personal, private, business, corporate and commercial services in South Africa. In addition, FNB introduced the facility of Petro Credit Cards for its consumers. This card is helpful for most people on their trips, especially in emergency conditions.

FNB Petro Card helps you in buying fuel from any fuel pump in South Africa. FNB Petro is similar to a credit card, and you can pay for tolls and for car maintenance. However, this card is like a credit card, but it has some limitations. FNB Petro credit Cardholder is not able to make any transactions from this card. Only those transactions are allowed which are related to your vehicles. Any person will also have free AA emergency roadside assistance when he has the FNB Petro card.

To apply for the Petro credit card, an individual should at least earn 84,000 Rand. The card will provide 15% back on your fuel payments. FNB Petro Card has a monthly fee of maintenance which is 55 South African Rand. FNB Petro Credit Card is of two types. One is a stand-alone petro card, and the other is a linked petro card. Both have different features and we will talk about them in this article.

Stand Alone Petro Card

The Stand Alone Petro Card has a separate credit limit and separate credit card statement. It is a separate card for an individual to manage Standalone Petro card gives his customers a separate credit limit and a specific credit card statement. It is a specific card for an individual to manage his vehicle and fuel expenses easily. Petro Card will allow you to bring a record of your fuel consumption which is helpful for taxation purposes. This Credit Card gives the customers access to free AA roadside assistance. FNB Petro card provides its customers with personalized interest rates.

Linked Petro Card

The Linked Petro cards are connected with your existing credit card and provide you with a combined limit with a transaction shown in the statement of a credit card. This card also has personalized interest rates. It also brings separate reports on the fuel expenses and also on vehicle expenses. It helps in consolidating your credit card repayment.

Other benefits of both FNB Petro Credit Cards

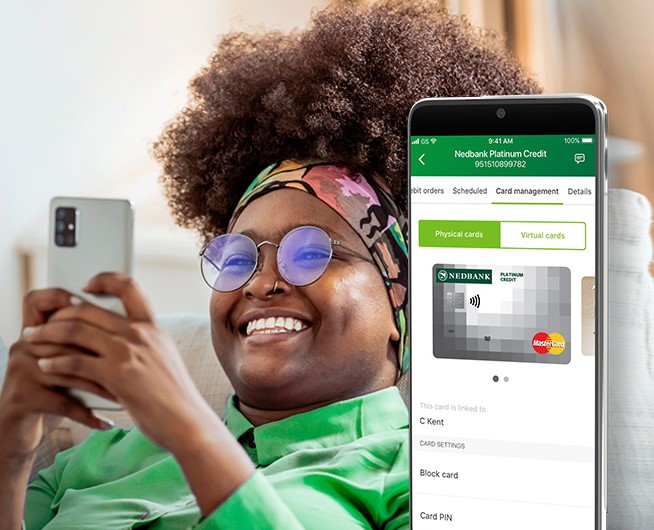

PetrPetro Cards brings you the facility of auto payments for your account on time. It provides access to online system of banking, telephonic banking, and mobile banking. A mobile application is also available for the use of FNB Petro Card customers. This Credit Card also brings free access to a feature known as inContact. Any individual who makes a transaction of 100 Rand or more than that gets a free SMS. This card has free contactless technology that gives opportunity to its customers to make quick and secure transactions for even low value purchases.

This card is available for low earning persons also. You only need to make 7000 Rand in a month to get this card. This card has recent updates that make it equal to new technology of credit cards. It provides convenience to its customers when they do not have enough cash flow. The customers may close down this card anytime but with some penalties. This card is usable nationally and internationally.

Secure Transactions

FNB Petro Credit Cards are secure for transactions. It brings a free card FNB Petro Cards are secure for transactions. It brings a free card loss protection and pins replacement facility. In addition, this credit card comes up with a pin to secure and a secure chip. This card helps in providing further security against the unauthorized use of Petro cards. It also has contactless technology for free to give you secure payments.

Services of FNB Petro Credit Card

FNB Petro Card serves the South African nation in every problematic situation during their journey. FNB Petro card provides its customers with free roadside maintenance and repair facilities anywhere in the South Africa. It helps in changing flat tires. If you need refueling, then it will provide the facility for up to 10 liters. In addition, anyone can take free tow-in services for his motor vehicle and it is limited to up to 40 km. The offer of towing in is available 24/7 and 365 days.

FNB Petro card brings help in restarting your flat battery. It also provides a service of a key lockout which has limited up to a maximum of 300 Rand (value-added tax included). Furthermore, Petro card takes care of its customers, so they bring courtesy services for them. In this service, the cardholder can get free overnight accommodation for himself and his four passengers. So, all is well for these Petro Cardholders during their journey.

Disadvantages

The FNB Petro cards are acting as special credit cards. If you have a credit card, then you do not need it. However, there are transaction fees for the transactions you make through Petro card. The more you need to purchase or transact, the more fees you need to pay.

How to apply for the FNB Petro Credit Card

The applying process for FNB Petro Card is not very complex. The person who wants to apply to get this card should have at least a South African ID. At the time of application, the individual who is applying must be over 18. If you are an account holder of FNB, then you may apply for the Petro credit card directly. The person who does not possess any FNB account must provide the past three months’ bank statement. The person applying for the card needs to provide a recent pay slip.

To qualify for an FNB Petro card, an individual must give the residence information not more than three months old. There are two ways to send an application for FNB Petro Credit Card. First, anyone can apply online for the Petro credit card from the FNB website. Second, the person may also apply through FNB mobile application for online apply. If anybody does not apply online, then go to FNB branches and submit an application for the card.

*You will be redirected to another website