Let us discuss the New Nedbank Gold Credit Card. Nedbank offers a variety of credit cards to suit the needs of various credit cardholders. Hence, Nedbank has a credit card available for you if you have a monthly gross income of at least R5000.00. So this one is designed specifically for people who wish to be awarded for regular everyday purchases. Also, those credit cards are designed for frequent travelers and offer an extra points scheme that may be used for traveling as well as other purposes.

Nedbank Credit Card Summary

The Nedbank Credit Card is designed for people who have jobs or entrepreneurs and thus have a steady stream of income. So to be eligible for a Nedbank Credit Card, users must be at least 18 years old, have quite a high credit score, be working full time, and make at least R60,000.00 annually. However, the card has a maintenance fee of R69.00 and also an annual equity charge of 19.65 percent.

New Nedbank Gold Credit Card

According to the Nedbank official website, “the Nedbank Gold Credit Card is a South African credit card that pays cardholders for their everyday spending.” As a result, the number of points you get is controlled by the type of Gold credit card you have. As a result, Nedbank has two American Express greenback credit cards available. The Nedbank greenbacks gold and platinum credit cards are among these greenbacks credit cards.

Furthermore, users must earn R100,000.00 at the most to be eligible for a Nedbank gold credit card. Thus users should indeed earn a limit of R350,000.00 per year to qualify for only a greenbacks platinum credit card. At this point, let’s take a look at the Nedbank gold credit cards’ features. However, we shall also discuss its benefits and all disadvantages it has to the South Africans.

Features of the New Nedbank Gold Credit Card

Users of the Gold credit card will be able to utilize international ATMs, It also includes a free SMS service. However, there are no transaction costs associated with it, and there is a 55-day grace period on the credit card. Additionally, when users purchase travel tickets, they will automatically receive basic travel insurance. Thus a service fee of up to R69.00 is charged, depending on your credit score. Also on some purchases, potential users can earn greenbacks.

Gold credit cards include conventional benefits such as a 55-day interest-free term and flight coverage. Zero service charges during a first card should be enough to brag about because this is generally reserved for platinum cards. So when tried to compare to Capitec Bank, which has a necessary yearly wage of R36,000.00 on their credit card, hence their required yearly gross is higher. The R64,000.00 gap is big, and Nedbank will also need to improve its performance mostly on Nedbank gold cards.

Application Eligibility for The New Nedbank Gold Credit Card

To be eligible for the Nedbank Gold credit card users must be at least 18 years of age or older. All users must have a good credit rating. However, the credit card is only for South African residents and users must earn R 350 000.00 or more annually for the Gold Credit Card. Nevertheless, you can get more details about other credit card cards like the Rakuten Credit Card and others when you visit our homepage, do not miss this opportunity. Read more here with us.

How to apply online

Registering for a credit card online might be an easy procedure. So all users have to do is complete the online application on their website. Also, make sure they have all of the required documents on hand so they can complete the documents. After they submit their registration, they will receive it from the financial institution within a few weekdays. Thus to know if they have been authorized or otherwise.

However, it may take approximately 10 business days for one card to be available after they have been accepted. So u users can pick up their credit card or have it sent once everything is done. Whatever choice users choose, they should make absolutely sure that they do have a valid South African ID at hand so that the delivery firm can verify that the Credit Card is being collected by the appropriate person.

Documents needed before applying

Users must provide proof of residence in South Africa, and also a valid South African green book ID or ID smart card. Thus they must also provide a recent payslip and 3 months bank statement before applying online. These are the necessary documents that are needed by all applicants for the Nedbank Gold Credit Card. So endeavor to have them at hand before approaching the site for registration.

Pros and Cons

Pros

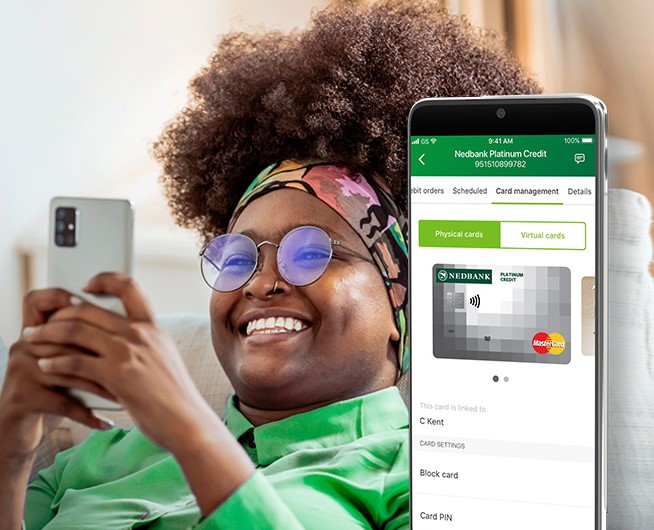

Nedbank will transfer money to any company in the Affiliation program that you specify. There were no transaction fees with the Nedbank credit card and also this credit card comes with built-in travel insurance. Thus the Nedbank banking app, on the other hand, allows you to get rid of some of the other apps you use to play with on your phone. This will help you free up space on your phone.

Cons

The Nedbank credit card has only a few cons, This is because users have few complaints about the card. One of the disadvantages of using the credit card is that Users of the Nedbank credit card must be South African residents, and they must make a substantial amount of money to qualify for the Gold Credit Card. As a result, credit card fees are higher than other credit card options.

Conclusion

Basically, the Nedbank Gold Credit Card is indeed an excellent card to consider. Hence users receive 55 days of interest-free credit, which also means users won’t be paying anything if they pay off their credit soon. So 0% transaction costs is a fantastic benefit. This is because it will assist you to avoid throwing money away on processing fees for an event that users may need to execute or every other day on occasion. Therefore If you’re the sort of person that enjoys traveling all over the world. As well as spend their money on fun and innovative events. Then automatic insurance coverage is a good benefit to really have.

*You will be redirected to another website